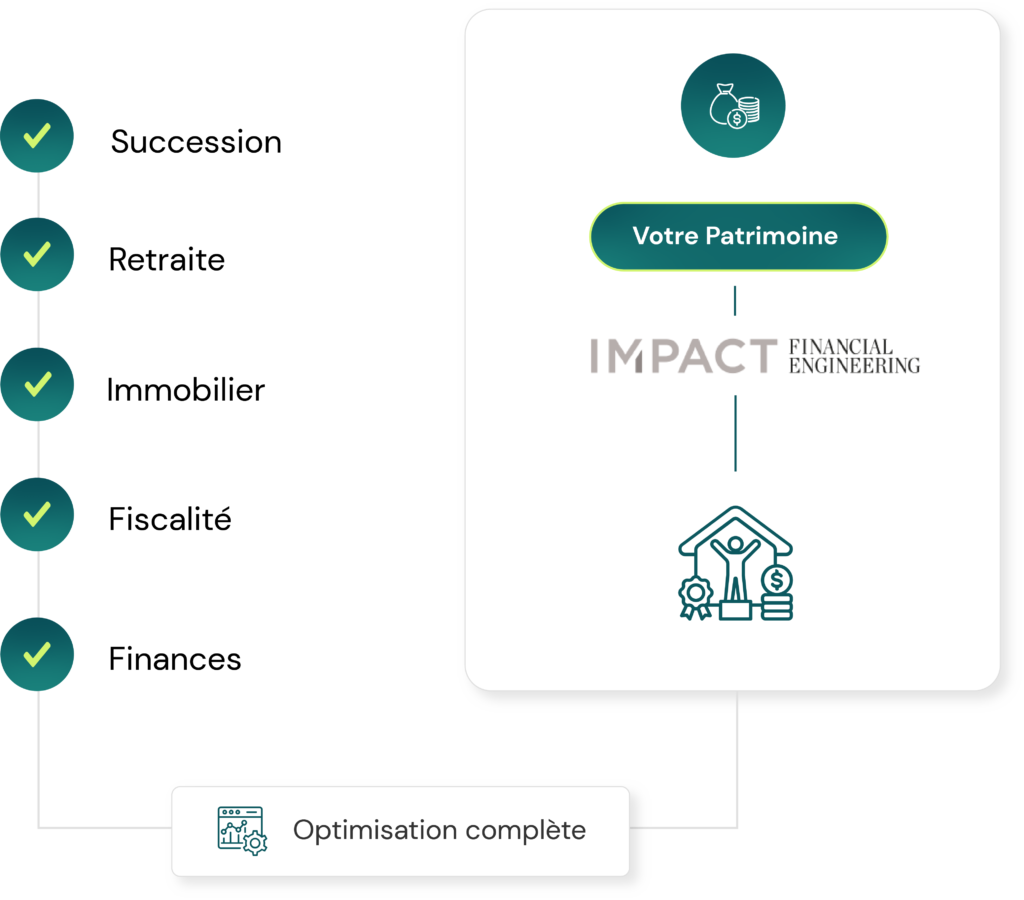

Tax and financial planning consulting firm

Plan with confidence: tax, wealth and retirement strategies tailored to your life in Switzerland

Control your taxes, plan your finances, secure your retirement and your assets with the help of our experts.

As close as possible to your needs

Our areas of activity

Tax advice

Personalised tax strategies to reduce your tax bill. Fully compliant with Swiss law

Financial planning

A clear plan for savings, investments and major life decisions. Built around your goals.

Retirement planning

Advice and strategy to maximize your old age provision.

Tax advice

Personalised tax strategies to reduce your tax bill. Fully compliant with Swiss law

Financial planning

A clear plan for savings, investments and major life decisions. Built around your goals.

Retirement planning

Advice and strategy to maximize your old age provision.

Financial advice

Independent guidance to structure and protect your wealth over time.

2nd pillar advice

Optimise your occupational pension (LPP): buy-backs, strategy and long-term impact.

3rd pillar advice

Use pillar 3a/3b to build retirement savings and reduce taxes effectively.

Financial advice

Independent guidance to structure and protect your wealth over time.

2nd pillar advice

Optimise your occupational pension (LPP): buy-backs, strategy and long-term impact.

3rd pillar advice

Use pillar 3a/3b to build retirement savings and reduce taxes effectively.

About our firm

At key moments—retirement, a career change, marriage or divorce, or a property purchase, we help you make the right financial decisions. We deliver end-to-end financial planning that connects taxes, assets and retirement, so you can move forward with clarity and peace of mind.

We offer you comprehensive financial planning, which carefully evaluates all the material implications of these steps. Our approach aims to provide you with peace of mind and clarity, allowing you to measure the positive impact of our optimization strategies on the evolution of your assets in the long term.

The firm's values

We combine expertise and innovation to guarantee a transparent and balanced structuring of assets, adapted to any stage of your life and to each of your personal and professional ambitions, whether desired or suffered.

What our clients say

Client reviews

FAQ

Frequently Asked

Questions

Do you have other questions? Our advisors are there to respond quickly and provide you with all the necessary information.

Our firm uses a personalized approach to reduce your tax burdens, leveraging strategies such as deduct optimization, retirement planning and wealth structuring, while scrupulously respecting Swiss tax legislation.

Impact Financial Engineering SA brings together a team of highly qualified advisors with +20 years of experience in the Swiss banking sector, wealth management, and wealth planning. Our experts, with certifications such as the CIWM (Certified International Wealth Management), the Federal Certificate of Financial Advisor as well as the Lawyer's Certificate, provide an in-depth and integrated understanding of tax and financial issues as well as foresight, guaranteeing personalized advice and adapted to each situation.

During our first discovery interview, we assess your needs in detail. Then, we develop a complete and personalized plan, supporting you step by step in its implementation, to guarantee maximum optimization in line with your long-term objectives.

Our prices are transparent and predictable. We operate on the basis of a fixed price mandate, determined after an initial interview during which we assess the workload necessary for your specific situation. For businesses, we offer several pricing plans adapted to their needs. Please do not hesitate to contact us for more information about our pricing structures.

We are committed to offering the best independent advice to optimize your economic and tax situation. 100% of clients who implemented the recommended measures obtained results consistent with the objectives defined together. Our commitment to quality and efficiency is at the heart of our practice and we work methodically and diligently to ensure customer satisfaction.

Tell us about your project

Our advisors are available and attentive to your project. Book an appointment to learn more about our services and find out how we can help you.